From Katherine He and Anil Achyuta, TDK Ventures

Overview

With a fundamental mission to accelerate hardtech in pursuit of a better tomorrow, TDK Ventures strives to be an impact scaler in electrification and other environmentally friendly innovation — continuously seeking out investment opportunities that continue to drive the right kind of Energy Transformation.

While electric vehicles (EVs) and other electrification projects hold the promise of global progress, true energy transformation will require exploitation of the world’s currently untapped lithium deposits at a scale not yet seen. The current battery-grade lithium supply has already started failing to meet global demand, and experts project this crisis to get much worse as necessity continues to skyrocket. While industry is already seeking to expedite extraction of lithium resources, such processes are timing consuming and costly, both with respect to financing and to the environment — due to high CO2 emissions, environmentally harmful chemicals, and large amount of water required.

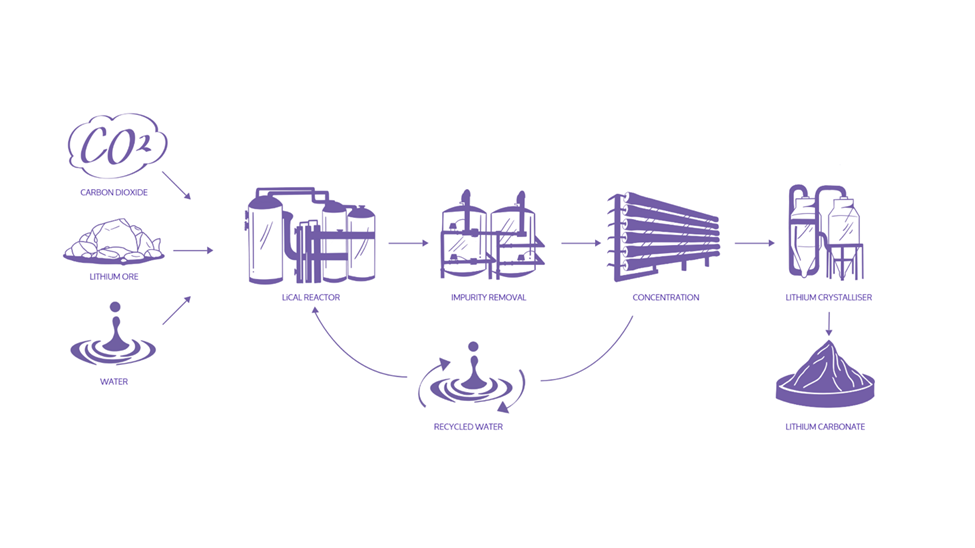

Australia’s Novalith is perfecting the technology that will make inefficient, environmentally disruptive, and resource-intensive lithium extraction a thing of the past. The company harnesses the benign power of carbon dioxide to extract lithium and convert it from a raw elemental material to the chemicals that battery manufacturers need. Novalith’s technique uses up to 90 percent less water than traditional methods and eliminates the need for toxic chemicals and strong acids in lithium recovery.

Introduction & Technical Evolution

Lithium Demand

Interest in lithium — the world’s lightest metal — has skyrocketed over the last several years, thanks in large part to blistering adoption of EVs. Most of currently-in-use EV battery chemistries, whether they use nickel manganese cobalt (NMC) type, or lithium iron phosphate (LFP) chemistries as cathode, graphite or silicon as anodes, or using novel solid-state electrolyte, lithium is the irreplaceable part in the lithium-ion batteries, serving as the lightest element carrying electric charge to store and release energy to power the modern society. This demand has led to a tightening lithium market with numerous downstream implications, with no end in sight as the market continues to grow.

According to an Associated Press report, the world will need more than 2 million tons of lithium in 2030 — more than six times the amount used in 2020 [1]. As EV prices reach parity with legacy cars and government mandates against production of internal combustion engine-powered automobiles take effect, EVs will become more mainstream, and with renewable energy production tailwinds growing in tandem, that figure will continue to climb to 50 times current consumption by 2050. By then 11.2 million tons of Lithium are predicted as the minimum to meet global need [2]. Only with an estimated 2 billion EVs replacing current transit on the world’s roadways will humanity have attained the critical mass required to achieve net-zero carbon emissions by mid-century — according to the International Energy Agency [3].

Each EV battery contains approximately 10kg of lithium on average, assuming extract from spodumene ore with Li2O concentration around 1~1.5%, one EV to produce will need to extract and refine from 1.4 ~ 2.1 ton of raw spodumene ore. With 2 billion EVs desired by 2050, it will drive the requirement of 20 million tons of lithium. [4, 5]. Not only will lithium production need to ramp up — by a factor of 10 or more over the next 20 years — but extraction methods must become more efficient to make EV batteries more affordable and to leverage lithium deposits that are not currently economically viable. In response to this global imbalance of supply and demand, further exacerbated by the incredibly short timeline driving progress, many EV OEMs have adopted a strategy integrating in-house battery manufacturing gigafactories into their supply chains to reduce risk associated with supply. However, this places more immediate pressure on lithium miners to keep up with demand. So, in general, in addition to long-term raw material availability, the timelines for lithium availability are currently a deep industry pain point. As Benchmark Mineral Intelligence CEO Simon Moores noted, “It takes five to 10 years to build a lithium mine. It takes only 24 months to build a battery plant. These two parts of the supply chain, they don’t live in the same time zone,” [6].

Scaling EV production cannot happen until extraction and refining stakeholders adopt technologies, just as innovative, which focus on cutting the time it takes to get this “white gold” out of the ground and into the batteries. Detailed by Qichao Hu, founder and CEO of battery maker SES, “Nearly every ton of lithium that currently operating mines will extract over the next four years has already been sold. Smaller and startup mines are years away from contributing to the supply, considering the exploration, feasibility studies, permitting, and other development requirements” [7].

Lithium Mining and Extraction Resources

Mining from Ore/Hard Rock Extraction

One of the two primary resources in current use for lithium extraction is in “the old-fashioned way” in a very literal sense of the phrase — traditional mining form ore and hard rock deposits.

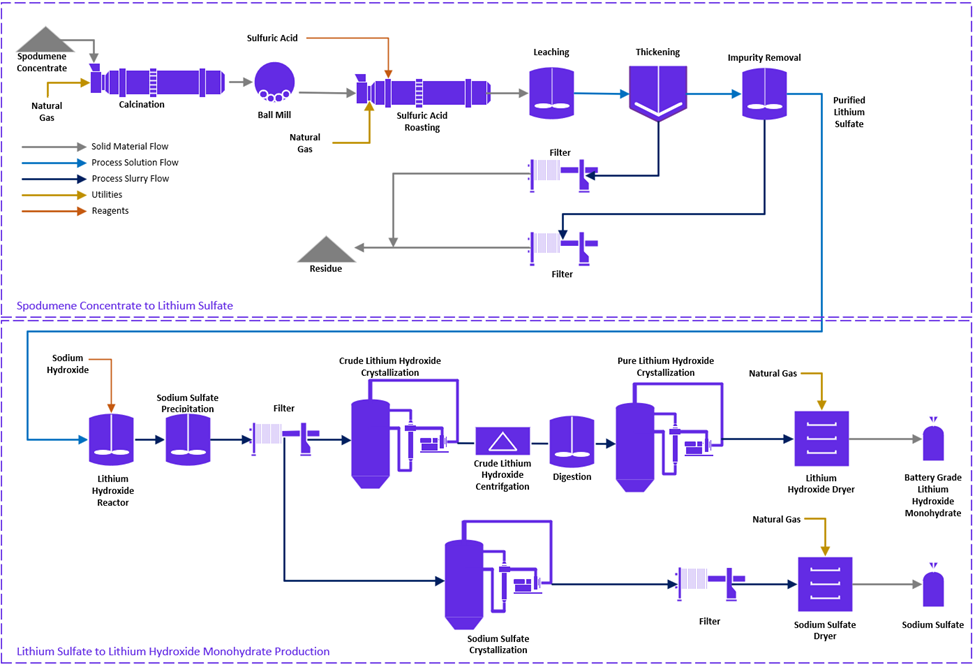

Much of lithium ore is in hard rock pegmatite deposits containing spodumene, and mining spodumene has not changed significantly since large-scale operations began. After the ore is extracted and crushed, it is subjected to a series of steps to separate the lithium from the rest of the rock — dense media separation, froth flotation, roasting and chemical leaching (e.g.: using sulfuric acid), impurity removal, filtration, conversion from the lithium sulphate to either lithium carbonate or lithium hydroxide, and finally crystallization to produce LiOH (lithium hydroxide) or adding soda ash for carbonation to produce Li2CO3 (lithium carbonate). The molecule is then stabilized, stored, and shipped. Upon receiving the lithium hydroxide (or carbonate), battery manufacturers and other processors then transform it into the final form (cell or a pack) they need for their applications.

From a value perspective, the quality and potential return of deposits depends primarily on the grade of the lithium they contain, byproducts from refining, such as cesium, beryllium, and tantalum can be commercialized to offset the cost of production. Impurities, on the other hand, increase refining costs, while the location of the deposit contributes transportation and logistical costs that could cut into profitability. While straightforward, a few key pain points associated with hard rock extraction make it far less than ideal when considering future expansion.

China holds a near-monopoly on processing on spodumene deposits and has purchased about 40 percent of the world’s lithium supply to fuel domestic demand for EVs/electronics and to export EV batteries to US and German carmakers. This creates an energy security challenge for the West, as China could limit exports as the need for batteries at home surges [8]. Mining operations require exorbitant capital expenditure (CAPEX) for the infrastructure and equipment required to execute. More than upfront cost, related issues of financing, royalties, labor, expansion, and other related development factors also increased risk. Related to the infrastructure required, hard rock extraction is also time consuming — both in the process of getting setup as well as general during operation, with production yield directly linked to the amount of capex investment. The necessary equipment required for operation incurs excessive CO2 emission and other associated impacts detrimental to the environment. This is problematic in its own right but is an additional strategic issue as it offsets the overall mission of electrification to decarbonize the planet.

Each of these challenges, both technical and financial, limit not just the current efficacy of hard rock extraction for lithium production but dampen any potential growth to meet future demand. “The old ways of financing and developing mines are inefficient and too slow,” notes Reuters. “It will take a concerted effort by governments, miners, end-users and investors to work out a way to accelerate development, while still meeting ESG goals and being as close to carbon neutral as possible,” [9].

Extraction from Brine

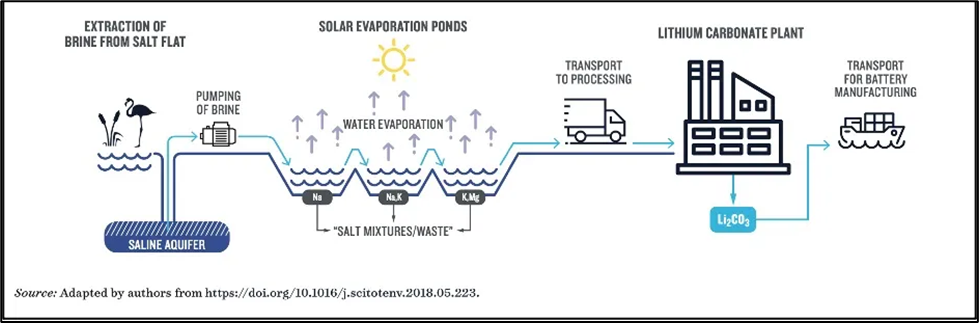

The other primary extraction resource in current use today is brine-water through evaporation (brine extraction). Lithium, contained on the order of a few hundred or even thousand parts per million (ppm), is first identified within saline aquifers deep within the Earth’s surface. The water is pumped from the underground aquifer and set in above ground (shallow) ponds. Once the water is evaporated via exposure to sun, lithium salt is left behind and can be collected and shipped to manufacturers for processing.

Brine-based approaches walk a tight balance between production and value constraints, and in many ways these mirror similar issues with hard rock extraction. The best lithium brine deposits are in areas where exposure to the sun, temperature, prevailing winds and other factors are conducive to rapid evaporation. As with hard rock mining, brine deposits’ grade, location, and concentration of valuable byproducts and harmful impurities weigh heavily on their profit prospects. Magnesium and sulphates are especially troublesome, as removing them is difficult and expensive.

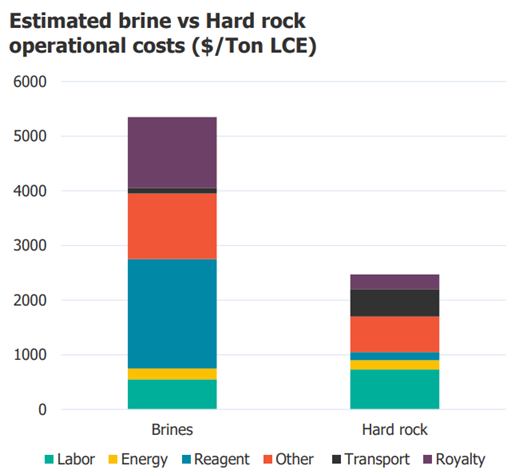

Brine extraction notably requires significantly less capital expenditure when compared to mining operations but has almost double the operational expenditure (OPEX) — much of which is associated with the required reagent material mixed into the shallow ponds to facilitate precipitation of lithium out of the water.

No matter how fast development and scaling occurs, brine evaporation is also unfortunately inherently time limited. The entire process can often take anywhere between 18–24 months up to collection following evaporation, and that does not include the necessary time to conduct chemical processing necessary to convert the raw lithium materials to carbonate form for delivery.

Brine evaporation is also detrimental to the environment in a few key aspects. By removing water, and more importantly not replacing the water, aquifers are damaged and can permanently alter the underlying ecosystem. This aspect is many times openly opposed and local interest groups understandably put significant effort to delaying development or production for these reasons.

Summary of Technical Challenges for Lithium Extraction

Worldwide demand for the lithium-ion batteries that power everything from smartwatches to laptops to electric vehicles will continue to grow for the foreseeable future. To satisfy the world’s hunger for lithium, mining and processing companies must overcome several barriers:

· Inconsistent resource quality — Brine extraction fields like those in Argentina, Bolivia, and Chile (the “Lithium Triangle”) typically the concentration of the brine water contains less than 0.4% of extractable lithium and varies across different salars and different radii and depth. Geothermal assets on the other hand struggle with even lower concentrate of less than 0.04% (400ppm). For spodumene, situations are better that after processing, spodumene yields has around 6–7% lithium compounds (20–200 times higher concentration than common brine sources). However, for all the lithium resources, only 33–40% are converted to battery-grade lithium. Producing high purity battery grade lithium from various deposits requires innovation on multiple fronts.

· Extraction costs — Though salar extraction is less capital intensive at the beginning, the brine operations incur more than double the cost per extracted ton than hard rock lithium mining incurs. Reagent chemicals such as precipitative sodium carbonate and lime and hydrochloric acid for solvent and ion exchange are required to collect the meager concentrations. Royalties, labor, water, waste management, and processing lag times add to the expenses. Hard rock mines pay much lower royalty fees and use significantly fewer chemical reagents in their operations. Labor costs are slightly higher, owing to the wage standards in Australia, where many hard rock operations are located.

· Geopolitical uncertainties — Economic conditions, socio-political uncertainties, lax environmental oversight, and other issues cloud the future of lithium mining and extraction, especially for brines that are in the South American Lithium Triangle. Argentina, Bolivia, nor Chile has particularly strong ties to the Western powers. The threat of nationalization, left-wing government, especially in Chile, cannot be ignored. Bolivia is known to be working with China and Russia to develop its largely untapped resources. Argentina is moving fast to commercialize its lithium but runaway inflation and tax policies that penalize foreign investors increase the risk for both startups and venture capital.

· Environmental concerns — The energy intensive, high pollution, high carbon emission exist in the whole process from lithium mining and extraction, to following refining, converting steps. Brine-produced lithium requires a 3,100-square-meter geographic footprint (seven times that of hard rock mines) and 500,000 gallons of water for every ton produced in evaporation ponds. Australia’s spodumene mines, however, emit three times as much greenhouse gas than brines [10]. Water is often a critical issue, with Indigenous peoples, ranchers, and environmentalists raising concerns over groundwater pumping and potential contamination [11]. The downstream processing that includes energy intensive refining, converting further deteriorate the life cycle assessment of the sustainability of lithium product.

· Supply chain logistics — As with other areas of the battery and electrochemical supply chain, most lithium processing capacity and demand is in Asia, necessitating strong, redundant, expensive, and possibly precarious supplier relationships among American and European EV battery manufacturers. The recent Inflation Reduction Act (IRA) is also taking actions to secure the national energy supply chain. However, the current state of lithium processing technology limits its potential for localization. The energy- and labor-intensive processes require location near population centers and metropolitan infrastructure. It would be preferable, given the relatively low concentrations in lithium carbonate and lithium hydroxide, that these refineries be located closer to their sources [12].

Where Lithium Extraction is going

By understanding the current landscape and motivations driving the progress of electrification, decarbonization, and overall energy transformation it becomes quickly apparent that a new paradigm for lithium extraction is needed. In particular, innovations that can reduce cost, expedite production, and operate at scale — without detrimental effects to the environment could be game-changing.

Of potential technological advances, one with perhaps the most promise is Direct Lithium Extraction (DLE). Summarized, DLE is a methodology that extracts lithium by selectively removing the lithium compounds from lithium brines. These solutions are a nascent option for improving the prospects of more efficiently recovering lithium from traditional brine extraction processes. We can also see technologies developing to do the same for hard-rock lithium resources, colloquially “DLE for hard rock”. Conceptually, the idea in both cases is to focus on the efficiency of extraction. However, these startup approaches remain untested at large scale over long timelines, with notable technical complexity and unvalidated unit economics.

Why TDK Ventures Invested in Novalith

TDK Ventures believes that technologies that support direct lithium extraction (DLE) are best positioned to provide battery-grade purity, given that they have access to high concentration, low-impurity deposits and can manage production costs and environmental impact. Of the technologies currently being matured by entrepreneurs across the lithium industry, due diligence conducted by the TDK Ventures team believes the “DLE for hard rock” innovator Novalith to be an up-and-coming, global, “King of the Hill” company that will change the game and tackle the discussed limitations head on. With global lithium prices surging 280% in 2021 and another 127% in the first quarter of 2022 [13] and booming demand for electric cars continuing, TDK Ventures believes Novalith stands to prosper from its innovative technology, unique business plan, and strong leadership.

Leveraging CO2 from the atmosphere, actually reducing the overall carbon footprint of industry, Novalith’s process separates and extracts lithium without the need for excessive refining infrastructure or the harmful chemicals used in brining. By innovating their own method, they’ve removed significant cost from the extraction process and can therefore pass on that savings to the lithium itself. This has incredible implications across the board for the industry. Not only does it contribute to a more economical bottom line for all lithium-battery powered products, but ensures both the application and the material sourcing aspects of electric power are environmentally friendly — an aspect which was previously hotly contested and held as a primary criticism of the electrification movement overall. To summarize their technology:

· Its extraction chemistry is highly selective, resulting in high recoveries and direct production of high-purity battery-grade lithium.

· It can be located at or adjacent to lithium sources, minimizing fuel, transport and storage costs.

· It streamlines the process, using less equipment and fewer reagents and taking up less space.

· It offers significant reductions in both operating and capital costs, whilst still producing a high-quality lithium product.

Immediate and lasting tailwinds for Novalith’s extraction approach

With the EV market’s expansion and an insatiable need for lithium-ion batteries for other mobility electrification applications such as aerial, industrial, fleet, two-wheel and three-wheel delivery vehicles and energy storage very probably constraining battery supply chains, OEMs and cell manufacturers will seek solutions to customer demands, increased competition, and longer delivery lead time by actively partnering and integrating lithium mining and refining businesses into their operations. Scalability challenges, resource demands, quality variability, and protracted production cycles, however, will hamper the ability of these strategic relationships and market entrants to alleviate the bottlenecks.

Novalith’s technology, on the other hand, will shorten domestic processing time by bringing it onshore and locating it next to the world’s most extensive and accessible hard rock lithium deposits. It allows for phenomenal cost savings by minimizing the inputs required — equipment, chemicals, labor, water, and energy. Just as important, conserving these resources and shrinking lithium extraction’s carbon footprint ensures a sustainable supply. Novalith’s ability to apply the process and co-locate the infrastructure near major lithium resources eliminates the need for shipping the lithium overseas for refining. Australian-produced lithium ore can be processed at Novalith co-location sites near the mines, ensuring supply chain resilience and further cutting emissions.

Novalith is about to launch a pilot plant facility in Sydney, the next step in the evolution of lithium extraction and refining technology. The company’s products and processes are expected to return hard rock lithium mining to the forefront, a distinction it has lost thanks to the prevalence of brine extraction.

Core technology that enables battery-grade Lithium production

Novalith’s technical innovations already have gained traction in the industry thanks to their environmental friendliness and extraction efficiencies. The company’s core innovations include the application of carbon dioxide in the extraction process. This contributes to global warming solutions by directly utilizing CO2 and sequestering tens of tons of carbon dioxide in lower quality lithium ores. While all TDK Ventures’ portfolio companies must comply to its high environmental standards, investment-worthy firms must also demonstrate commercialization and go-to-market potential. Novalith’s LiCAL™ process reduces the number of steps, the amount of equipment, and the labor hours required to acquire lithium from ore, cutting capital and operating expenditures by up to 50 percent.

Adding to the financial viability of implementing the Novalith technology, carbon credits from CO2 sequestering are currently worth $85 per ton. Converting the credits reduces costs by 4 percent, more than paying for the expense of capturing and purifying the CO2.

A team that is up to the task

Novalith’s leadership team and stable of technical and business advisors give it another strong advantage. Chief Executive Officer Steven Vassiloudis brings a wealth of experience to the position as an accomplished chemical engineer. His expertise includes process scaling and commercialization of new technologies. He is an engineering problem solver with diverse industry exposure and a keen focus on clean energy solutions. Chief Technology Officer Andrew Harris is a professor of chemical engineering at the University of Sydney. He researches sustainable development solutions at the nexus of materials science, chemistry, physics, and engineering. He is an expert in in commercializing and scaling up novel process technologies. Business Development Officer Christiaan Jordaan is a founder of Sicona Battery Technologies and has built a strong network throughout the EV battery and lithium supply chain. The company’s advisory board includes David Deak, chief technology officer for Lithium Americans Corp., and Brian Haynes, upon whose intellectual property the Novalith technology is founded.

The right rocks and stability down under

Finally, as an Australian company, Novalith benefits from a stable, democratic government and proximity to the world’s most productive lithium deposit. For example, the Greenbushes mine is the largest hard rock lithium mine on the planet, producing close to 2 million tons of lithium-rich spodumene ore annually. Novalith also is eligible for support from the Australian government and U.S. concern over China’s influence and control over sensitive materials and technologies influencing economic hegemony and national security. The recently passed Inflation Reduction Act includes tax credits for new consumer EV purchases. More important, Australia stands alone among a leading lithium provider with a strong record of property rights and friendly free trade agreements as the IRA requires of America’s trade partners [14].

These factors and the expected continued demand for lithium positions the company as “King of the Hill” — a designation weseek in all its investment opportunities. As the industry matures, we will be able to mobilize its resources — in addition to our financial backing — to assist Novalith in scaling production, expanding facilities, developing markets, solidifying the supply chain, branding, and more.

Future Vision

TDK Ventures’ investment in Novalith advances the company’s plan to build out its pilot plant facility in Sydney, Australia and upscale its LiCAL™ technology to secure its first commercial demonstration plant project. Further, Novalith intends to use investment proceeds to onboard a full business-development team to solidify partnerships with junior and major mining operations, as well as with governments to acquire new mining assets.

TDK Ventures invested with deep conviction that Novalith is a clear example of our mission to achieve a triple bottom line of excellent financial outcomes, exciting strategic potential, and clear benefit to society. The team at Novalith are clearly tackling one of the most pressing and lucrative problems in the energy transition, and we are excited to support them with the full force of TDK in order to ensure our electrified future is as clean as technically possible. If you’d like to learn more about the future of Lithium extraction that Novalith is building, don’t hesitate to reach out!

References

1. Whittle, P. (2022, March 28). U.S. seeks new lithium sources as demand for clean energy grows. PBS Newshour. https://www.pbs.org/newshour/economy/u-s-seeks-new-lithium-sources-as-demand-for-clean-energy-grows

2. Benchmark Mineral Intelligence. (2022, October 13). Lithium has to scale twenty times by 2050 as automakers face generational challenge https://www.benchmarkminerals.com/membership/lithium-has-to-scale-twenty-times-by-2050-as-automakers-face-generational-challenge/

3. Bouckaert, S., Pales, A. F., McGlade, C., Remme, U., Wanner, B., Varro, L., … & Spencer, T. (2021). Net Zero by 2050: A Roadmap for the Global Energy Sector. https://iea.blob.core.windows.net/assets/deebef5d-0c34-4539-9d0c-10b13d840027/NetZeroby2050-ARoadmapfortheGlobalEnergySector_CORR.pdf

4. World Economic Forum. (2022, July 20). The world needs 2 billion electric vehicles to get to net zero. But is there enough lithium to make all the batteries?

https://www.weforum.org/agenda/2022/07/electric-vehicles-world-enough-lithium-resources/

5. Lithium: What is it and do we have enough? (2020, November 30). Hackaday. https://hackaday.com/2020/11/30/lithium-what-is-it-and-do-we-have-enough/

6. Fuelling, G. (2021, May 26). How Lithium Became a Hot Commodity (2021, May 7). LinkedIn. https://www.linkedin.com/pulse/timeline-requirement-lithium-projects-gerrit-fuelling/

7. Morris, C. (2022, April-June). The EV raw materials crunch: How bad, how long, how to solve it? Charged. https://chargedevs.com/features/the-raw-materials-crunch-how-bad-how-long-how-to-solve-it/#:~:text=As%20Dr.,build%20a%20new%20lithium%20mine.%E2%80%9D

8. Katwala, A. lithium (2022, June 30). The world can’t wean itself off Chinese. Wired. https://www.wired.co.uk/article/china-lithium-mining-production

9. Russell, C. (2022, October 12). How do you accelerate energy transition when current crisis slams the brakes Reuters. https://www.reuters.com/markets/commodities/how-do-you-accelerate-energy-transition-when-current-crisis-slams-brakes-russell-2022-10-12/

10. Xander, M. (n.d.) The earthly impacts of extracting lithium. Tallahassee Community College. https://www.tcc.fl.edu/media/divisions/academic-affairs/academic-enrichment/urc/poster-abstracts/Xanders_Madison_Poster_URS.pdf

11. Hiyate, A. (2022, October 13). Mining’s problems are now the world’s problems, as lithium scale-up issues show. The Northern Miner. https://www.northernminer.com/editorial/minings-problems-are-now-the-worlds-problems-as-lithium-scale-up-issues-show/1003847392/

12. Breiter, A., Horetsky, E., & Rettig, R. (2022, October 18). Power spike: how battery makers can respond to surging demand from EVs. McKinsey & Company. https://www.mckinsey.com/capabilities/operations/our-insights/power-spike-how-battery-makers-can-respond-to-surging-demand-from-evs

13. Trading Economics (n.d.) Lithium. https://tradingeconomics.com/commodity/lithium

14. Broughel, J. (2022, September 14). How The Inflation Reduction Act Could Cause A Lithium Crunch. Forbes. https://www.forbes.com/sites/jamesbroughel/2022/09/14/how-the-inflation-reduction-act-could-cause-a-lithium-crunch/?sh=b54d91442c18