Introduction

Energy Transition is a Metals Transition

The global shift towards the energy transition is a massive undertaking that hinges on numerous technological and societal advances. Pervasive to almost all aspects of the energy transition, however, is first and foremost a resource availability challenge. The true global energy transition is at its core a metals transition.

The International Energy Agency (IEA) forecasts a 500% surge in critical mineral consumption to achieve an 80% global renewable energy penetration 1. This increase is driven by emerging energy transition technologies’ escalating demand for minerals. For instance, the manufacturing of electric cars demands six times more mineral inputs than their conventional counterparts. At the same time, offshore wind plants require 13 times more mineral resources than a similarly sized gas-fired facility 2.

Platinum group metals (PGMs) and copper are among the critical minerals that are anticipated to suffer supply shortages in the near future. PGMs, comprising six rare elements, are employed across diverse industries, notably as industrial catalysts and autocatalysts. With tightening global emissions standards, PGM demand is expected to escalate. PGMs are also utilized in emerging technologies, such as hydrogen fuel cells, electrolyzers, and many electrochemical processes, where no other materials have demonstrated comparable activity, selectivity, and stability.

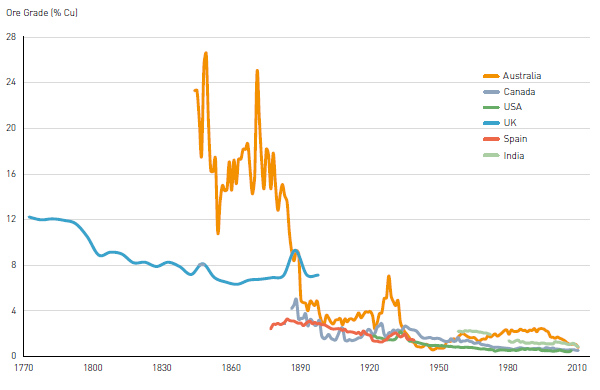

As for copper, its use in electric vehicles (EVs), charging infrastructure, photovoltaics (PVs), wind turbines, and batteries renders it a cornerstone metal for the energy revolution, but the supply of copper is dwindling. The copper content in the copper ore has dropped from 4% at the start of the century to less than 1% today. Because of the declining ore grades and mine closures, production from existing copper mines is expected to decline at a CAGR of 4.7% between 2026–2030. Meanwhile, the permitting process for a new mine has taken a much longer duration, stretching from 3–4 years in 1956 to 16 years today for major copper projects 3. Given those factors, the impending copper deficit looms as early as 2025 4.

Figure 1. The declining copper ore grades from selected countries 5

Geopolitical and trade issues have further strained the availability of metal resources. China, boasting 40% of the world’s copper processing capacity, maintains a dominant position in the copper market. Russia is the second-largest producer and fourth-largest exporter of PGMs. The ongoing Russia-Ukraine conflict has resulted in flight bans and sanctions on Russian PGM supply, intensifying pressure on the PGMs supply chain.

Figure 2. Energy transformation including enabling the continued advent of electric vehicles will only be possible if the critical metals used in their manufacture can be sourced at scale.

Limitations in the Current State of the Art for Metal/Mineral Acquisition

Mining and recycling represent the primary avenues for sourcing and refining these identified critical minerals, yet traditional methods are marked by notable constraints. Pyrometallurgy or smelting, a process that involves melting metals using high heat, currently constitutes 80% of global primary copper production. Because of the low copper content in the ore (typically 0.5–2%), a concentration step is needed to enrich copper to about 30% before smelting 6. The pyrometallurgy approach is effective in extracting copper from chalcopyrite (CuFeS₂), which constitutes 70% of the earth’s copper reserves. However, pyrometallurgy is highly capital and water-intensive, and there is limited smelting capacity in some locations. It was estimated that producing 1 ton of copper by pyrometallurgical method consumes over 40 GJ of energy, comparable to the annual electricity consumption of an average US household 7. Furthermore, in Chile, a staggering 540 m³ of water, equivalent to about 4.5 Olympic swimming pools, is used every minute for copper pyrometallurgy 8.

The hydrometallurgical method has also been used to leach copper from copper oxide and chalcocite (Cu₂S) ores using a combination of an aqueous acid solution (e.g. sulfuric acid) and an oxidant (e.g. oxygen, peroxide, Fe³+, bacteria). Impurity is then removed by a solvent extraction process, and copper ion is subsequently reduced into metal via an electrowinning process. The leaching time for chalcocite (Cu₂S) and oxide minerals may vary from 3 months to 3 years in the heap leaching operation. On the other hand, chalcopyrite (CuFeS₂) does not react to any significant extent under the mild heap leaching condition 6. There have been several studies to enhance hydrometallurgical extraction of chalcopyrite as an alternative to the pyrometallurgical approach. However, these new approaches have yet to be proven at scale.

Pyrometallurgy is also the predominant approach to recycling copper, PGMs, and other critical minerals from different waste streams. However, the process’s adverse emission profile has sparked significant public resistance against recyclers that employ pyrometallurgy. A notable instance is Glencore’s smelter, which takes in e-waste and other scrap materials to produce copper and precious metal products. The high arsenic emissions from the facility have subjected it to intense public scrutiny and potential shutdown 9.

Beyond its environmental implications, pyrometallurgy also faces technical challenges when applied to specific feedstock. For example, it is unsuitable for recycling PGM catalysts from fuel cell membrane electrode assemblies (MEAs), which contain fluorinated compounds that can produce toxic off-gases and byproducts when processed under high temperatures. Furthermore, pyrometallurgy cannot effectively extract PGMs that are deposited on SiC or Zi/Ti substrates, which have high melting points, while stringent emission regulations necessitate a shift toward SiC and Zi/Ti substrates in new catalytic converters 10.

Introducing pH7 Technologies: A Sustainable Answer to Extraction Challenges

pH7 Technologies, a Canadian startup founded in 2020, is poised to provide a key pathway to reliable and sustainable metal sourcing and revolutionize the industry with its environmentally friendly extraction method that addresses metal extraction challenges head-on.

pH7 Technologies has developed a sustainable, proprietary closed-loop extraction method that operates at low temperatures, addressing the challenges faced in metal recycling and mining. With a PGM recycling pilot operating daily and a commercial plant soon to come online, pH7’s process consumes 84% less energy, 98% less water, and produces no NOx and SOx emissions compared to existing extraction approaches. The innovative PGM extraction platform offered by pH7 has numerous advantages over traditional pyrometallurgy processes. It eliminates the need for toxic or hazardous reagents, is capable of handling PGM substrates with high melting points such as SiC, Zr, Ti, and fluorinated compounds, and boasts an impressive recovery rate and purity. Furthermore, the scalability of the process, facilitated by fast reaction kinetics, simple process flow, accessible reagents, and no aqueous discharge, has caught the attention of major PGM catalyst manufacturers, traders, and recyclers, who have signed commercial agreements to supply substantial quantities of end-of-life PGMs to pH7 for treatment.

On the copper side, pH7 is developing a closed-loop extraction process to extract copper from both e-wase and low-grade ores. When dealing with e-waste, pH7 has demonstrated 95%+ copper recovery at mild operating conditions. The process is also effective in recovering other important metals in e-waste, including gold, silver, PGMs, nickel, and tin.

As for low-grade copper ores, pH7 is designing a closed-loop, electrochemical organic extraction system applied to heap leaching of chalcopyrite ores and tailings to overcome the kinetic bottleneck of existing methods that use an acid solution and an oxidizing agent or bioleaching. The reagent in pH7’s process is recovered and reused, which leads to a low-cost, sustainable copper extraction process.

pH7 Technologies offers an innovative and sustainable solution to the critical challenges faced in the extraction and recycling of PGM and copper. The revolutionary organic electrochemical extraction method not only reduces the environmental footprint but also provides higher recovery rates and scalability. With its game-changing technology, pH7 Technologies is set to become a vital player in the global effort to secure the supply of critical metals for the energy transition, while mitigating the environmental and geopolitical concerns that have plagued traditional extraction methods.

TDK Ventures’ Strategic Outlook: Why We Invested in pH7 Technologies

TDK Ventures is proud to have invested in pH7 Technologies, as the company aligns perfectly with our investment criteria and strategic outlook. Our conviction in pH7 investment came from several reasons:

- Large total addressable market: The collective global markets for copper and PGMs are estimated to approach $360B by 2030. Stakeholders across primary and secondary metal extraction sectors are actively seeking innovative solutions to tackle existing challenges, establishing a platform for startups to capitalize on this expansive market potential.

- Timely regulatory tailwinds: Legislators worldwide are introducing regulations to bolster and ensure domestic security regarding critical minerals. The Canadian government, for instance, has allocated multi-billion dollars toward its Critical Mineral Strategy, aimed at propelling the advancement of critical mineral resources and their associated value chains. Likewise, the US Inflation Reduction Act encompasses various credits designed to incentivize both domestic critical mineral production and adoption. This convergence of measures underscores a favorable regulatory environment for investments in this sector.

- An elegant solution that improves both process sustainability and productivity: After reviewing various solutions in the PGMs and copper extraction space, pH7’s solution stood out to us as the King of the Hill in this space with its low energy and water usage, minimal waste generation, high production yield and purity, and attractive technology scalability.

- A fast-moving team focuses on execution and growth: With over a decade of experience in metal extraction and refining, the company CEO Mohammad Doostmohammadi has assembled a proficient team at pH7 to scale the technology at a fast pace. Within the first half of 2023, the team has expanded its pilot plant production capacity from 100kg/day to 500kg/day and their first commercial-scale plant in Vancouver, BC will come online within the first half of 2024.

- Strategic alignment with TDK: TDK produces a wide range of products that play a critical role in the energy transition. By investing in pH7, TDK can be better prepared for the material transition necessitated by the shift toward clean energy. The investment in pH7 will help TDK align its products with sustainability principles, thereby contributing to the company’s long-term growth and success.

Future Vision

TDK Ventures invested with a deep conviction that pH7 Technologies is a clear example of our mission to achieve a triple bottom line of an excellent financial outcome, an exciting strategic potential, and a clear benefit to society. We eagerly anticipate the company to further scale its technology across diverse feedstock streams and expand its operation into different geographical regions. If you’d like to learn more about the future of the green metal value chain that pH7 Technologies is building, don’t hesitate to reach out!

References

Lux research. (n.d.). Lux Research.

2 Executive summary — The role of critical minerals in clean energy transitions — Analysis. (n.d.). Retrieved from https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions/executive-summary

3 Soares, A. (2021) Copper project pipeline — Project shortage to see supply lag demand post -2025.

4 S&P Global. (2022). The Future of Copper Will the looming supply gap short-circuit the energy transition? https://cdn.ihsmarkit.com/. https://cdn.ihsmarkit.com/www/pdf/

5 Kihl, A. and Aid, G. (2016). Driving forces and inhibitors of secondary stock extraction. The Open Waste Management Journal. 9(1):11–18. DOI:10.2174/1876400201609010011

6 Schlesinger, M. E., King, M. J., Sole, K. C., and Davenport, W. G.(2011). Extractive Metallurgy of Copper, 5th Edition. Elsevier.

7 Marsden, J. (2008). Energy efficiency & copper hydrometallurgy. Freeport-McMoran Copper & Gold.

9 Paben, J. (2022). Pollution issues threaten Glencore smelter in Canada.

10 The auto catalyst precious metals dilemma. (n.d.). Retrieved from https://www.preciousmetalscommoditymanagement.com/blog/the-auto-catalyst-precious-metals-dilemma