Introduction

Anil Achyuta, Investment Director, TDK Ventures

Overview

Verdagy’s innovations in hydrogen production technology represents a paradigm shift in hydrogen electrolyzer technology and represent a tractable pathway for hydrogen to decarbonize hard to abate sectors like petrochemical, mining, and steel manufacturing. In partnering, Verdagy and TDK Ventures seek to work together towards their mutual vision for energy transformation, and to accelerate their technology to market to bring about the future sooner rather than later.

Historical Perspective

Interest in hydrogen, and hydrogen electrolyzers stems directly from energy and humanities need for a sustainable, high energy content fuel. The first law of thermodynamics can be phrased in a couple ways but comes down in essence to: energy can neither by created or destroyed, rather energy can change form from one type to another. Long before we understood this reality of the universe formally, humanity learned to abide by and leverage this concept to our advantage. If we wanted to do work, we needed energy — our own, an animal, or in more recent history electrical or fuel based. If we wanted heat the same was true. Whatever the end energy output was, to provide it we needed to input energy in some other form.

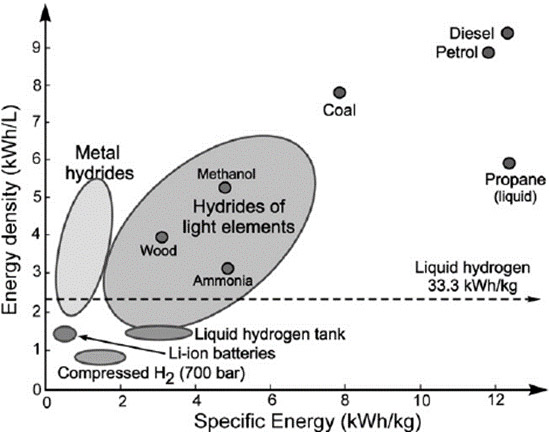

Now, of course, not all energy sources are created equal. Wood is excellent for a nice roaring fire to keep us warm, but if we are trying to operate factory equipment or a moving vehicle that’s not going to cut it! Over the past thousands of years mankind has gotten quite good at identifying fuel sources with what is called energy density or specific energy — the former is the amount of energy contained in a material per unit volume and the latter is amount of energy per unit mass. Figure 1 compares several types of fuel sources in terms of both energy density and specific energy.

Figure 1. A comparison of energy content for some of the most common and most relevant fuel sources. Sartbaeva, Asel, et al. “Hydrogen nexus in a sustainable energy future.” Energy & Environmental Science 1.1 (2008): 79–85.

Considering the figure, it is easy to understand why fossil fuel, hydrocarbon, based energy sources like petroleum (petrol), diesel, and coal are so highly valued. In comparison to most other fuel sources, they are both more compact per unit volume and more lightweight in terms of mass. You get more energy in a smaller package giving both high yield and at a less costly price point. This is what has driven the global energy dependence on such materials for the past approximately two hundred years — with an exponential increase post industrial revolution.

Before the pandemic, the US alone consumed over 80 quadrillion BTU’s of fossil fuel energy in a single year (2019, https://www.statista.com/statistics/183617/us-energy-consumption-from-fossil-fuels-since-1985/) with fossil fuels making up over 80% of total energy types used. While this demonstrates an overall decreasing trend, down from 96% of total energy in 1965, the decrease does not compensate for the significant increases in total consumption. This has had a devasting effect on the homeostasis of the globe and recently driven an overwhelming call for energy transformation in recent years. The problem can then be stated very plainly: How can energy demands of humanity be met in a sustainable way not dependent on fossil fuels?

While this question has stemmed many areas of research into alternative and sustainable energy sources (wind, hydro, solar, etc.) one answer can be found in referencing the same Figure 1. Hydrogen, particularly liquid hydrogen, possesses almost three times the specific energy content of even the highest valued fossil fuels. Notably in terms of energy density the inverse is true, and hydrogen has about one-third the energy per unit volume — so 1/3rd as compact but 3x as light. These characteristics make hydrogen very well-suited as an alternative to fossil fuels.

Problem solved then, right? Not quite. Despite hydrogen being an incredibly common and abundant element in the universe (the most common in fact), it rarely exists in isolated form on Earth and so technical challenges (and associated business opportunities) related to hydrogen as a fuel source must first address the efficient production and compaction of it to in a fuel-friendly form.

What is the state of hydrogen production today?

The current industry standard for hydrogen production, accounting for over 90% (https://www.energy.gov/eere/fuelcells/hydrogen-production-natural-gas-reforming) of total hydrogen generated is steam-methane reforming (SMR). High pressure, high temperature steam reacts with natural gas, usually methane, to ultimately form carbon dioxide and hydrogen gas CH4 + H2O (+ heat) → CO2 + 4H2. While very effective, and economical at generating hydrogen, this process is inherently carbon emitting with a tremendous amount of CO2 produced as a byproduct. Total yearly CO2 emissions from SMR-based hydrogen production alone equals more than 2% of global total. As such, finding a similar cost green alternative to SMR hydrogen would be a critical step to enabling a hydrogen-based pathway for deep decarbonization and a sustainable energy future.

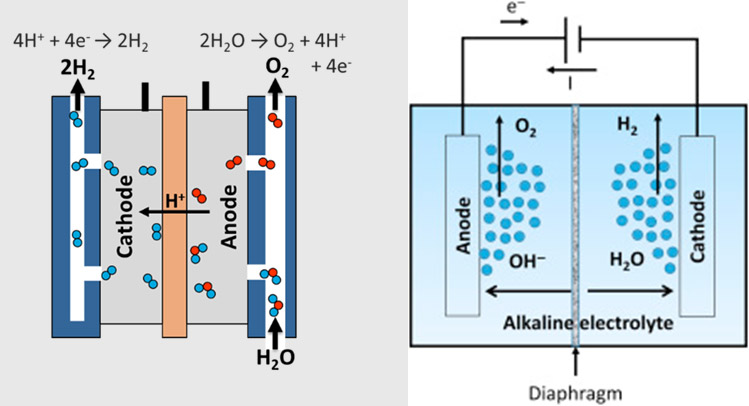

One of the most promising carbon-free solutions for hydrogen production is electrolysis, particularly when used in tandem with a renewable or nuclear energy resource. Summarized by the US DoE (https://www.energy.gov/eere/fuelcells/hydrogen-production-electrolysis), electrolysis is the process by which electricity is applied to water at sufficient power to split the oxygen and hydrogen atoms from each other allowing the collection of pure hydrogen. In all cases, this consists of an anode and a cathode in water separated by some sort of electrolyte — the make and function of which depends on design and has led to the creation of many different types of electrolyzers capable of variable size, scale, and output. Two of the more common examples include proton) exchange membrane (a.k.a polymer electrolyte membrane) (PEM) electrolysis which utilizes a polymer membrane that only allows the passages of hydrogen ions (protons) to flow through, or alkaline electrolysis where OH- is split from a water/electrolyte solution by the anode, is passed through a membrane and further separated to hydrogen at the cathode point (Figure 2).

Figure 2. Schematics of (Left) Polymer/proton electrolyte membrane electrolysis, and (Right) alkaline electrolysis. https://www.energy.gov/eere/fuelcells/hydrogen-production-electrolysis. https://www.sciencedirect.com/topics/engineering/alkaline-water-electrolysis.

Unlike SMR, the electrolysis process is an inherently carbon-free reaction. However, the power needed to drive the reaction is not. Electrolysis driven by the standard power grid for example is just as unsustainable as the grid itself, because the grid runs on coal in many places (albeit there is a good momentum on natural gas and renewables). The uniqueness comes from linking the hydrogen production to another sustainable source which then allows a truly carbon-free solution — a solution which may very well be the key to true energy transformation.

Current difficulties associated with electrolysis come down to two related but distinct factors; cost and scale. Recent prices, in terms of dollar per kg generated, can vary anywhere between 2 to even 5 times the cost of equivalent carbon-based fuel. Much of that variation depends on the cost of electricity used to drive the electrolysis with further price wrapped up in infrastructure and the intrinsic immaturity of the technology. Scale is the other key driver. The base reaction in electrolysis is dependent on applying current to the water with hydrogen bubbling off at the cathode. The more “active area” for this application of current the more hydrogen generated over any given time, however the more active area the more current required and the more cost. This requires high current density to be able to balance these factors, a pursuit that is still an active area of research.

TDK Ventures’ Strategic Outlook on the Hydrogen Electrolysis

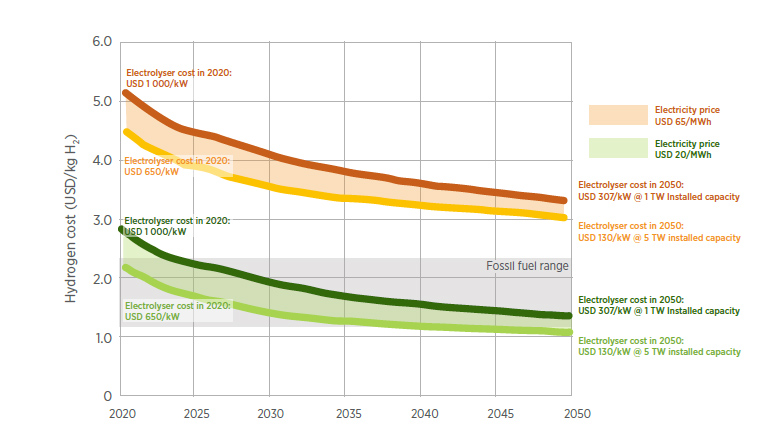

At TDK Ventures, we have paid close attention to trends in green hydrogen production and particularly to developments in electrolysis technologies. Particularly, we have been watching some of the hard to abate sectors like chemical synthesis (petrochemical), mining, steel, , all of which that use SMR hydrogen at the site of the reaction. We felt that these hard to abate sectors will be the first applications for green hydrogen because applications in transportation require green hydrogen to be compressed, transported to the site of fueling, and then converted back into electricity, all of which have issues around cost competitiveness and lack efficiency. As shown in Figure 3, innovations in hydrogen technologies, combined with more efficient electricity prices, are expected to drive the cost of hydrogen product to that of fossil fuels or less in the coming decades.

Figure 3. Taibi, E., Blanco, H., Miranda, R., & Carmo, M. (2020). Green Hydrogen Cost Reduction; Scaling up Electrolyzers to meet the 1.5 C Climate Goal.

The reduction in price signals a tremendous boom in the hydrogen, electrolysis, and hydrogen production/storage markets as it becomes a green, high-energy density, alternative to fossil fuels — offering both positive sustainable change with minimal compromise in humanity’s demand for energy. At TDK Ventures, we want to not only enable this curve to become reality but want to accelerate its fruition and ideally help create a new curve altogether. Hence, we began the pursuit of the “King of the Hill” in the electrolysis space that would give us the highest green hydrogen output for the most optimal cost.

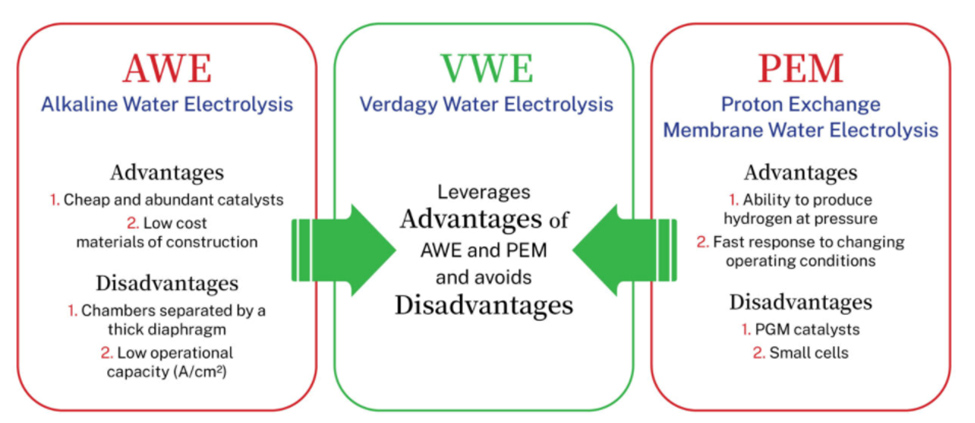

Enter Verdagy. The name says it all in this case, derived from “verde” (green) and “agy” (energy), Verdagy is quickly making a name for itself as a leading innovator in green hydrogen water electrolysis technology. Their mission is to enable industrial sector decarbonization through large scale green hydrogen production. Verdagy takes the best of current industry standard practices and combines them in a way optimized for industrial scaling (Figure 4).

Figure 4. Verdagy Water Electrolysis takes the best of both current industry standards and optimizes to make a viable pathway for large scale production. https://verdagy.com/approach/

Verdagy’s approach leverages three key innovations to address both the scale and cost challenges associated with electrolysis as previously discussed, and hence we determined them as the King of the Hill –

- Large active areaThey created electrolysis cells with the largest active area in the industry ringing in at 28,500 square centimeters (over 30 sq. ft.). This will enable mass production up to 20 MW per electrolyzer and represents a viable path to full industrial scaling.

- High current densityBy increasing the amount of current per area (or “current density”), you can increase the amount of hydrogen produced per cell, which directly translates to fewer cells needed for a fixed amount of hydrogen production and lower overall capital expenditure. Verdagy’s proprietary cell architecture, balance of plant design and operating conditions enables Verdagy to run at the highest current densities in class.

- Operation price optimizationTheir “eDynamic™” plant operational process varies operation and production based on the price of power supplies, meaning more hydrogen is made when the cost of energy is at its lowest, while production is tapered during high-cost time durations. This system advantage in conjunction with the improved production technologies is a game changer and could enable that entirely new curve sought after for Figure 4.

At TDK Ventures we have done our due diligence with respect to the state of the art, historical context of hydrogen production, and considered the market signals which are overwhelmingly pointing toward excessive growth. The solutions brought to light through Verdagy represent incredible potential to tap into the hydrogen megatrend of the future and accelerate technology to bring about meaningful change exactly when we need it. Our investment and partnership with Verdagy moving forward can be summarized and substantiated in answering the following questions on our triple bottom line value proposition:

- Does this unlock meaningful megatrends in transition? YES! Verdagy has significant potential to be a game changer in hydrogen electrolysis technology and tap into the megatrend green hydrogen fuel market that is imminent to skyrocket.

- Does it provide venture like returns?YES! With cutting edge technology that is expected to shift the way the entire industry operates, and a market expected to boom to $53 billion by 2030, the answer is definitely a yes.

- Does this provide strategic value?YES! Such a partnership places TDK firmly ensconced in not just the hydrogen electrolyzer market, but the hydrogen production market overall in the form of electrode design, power supplies, balance of plant, and other system components as its set to progress and see significant innovation in the coming decade.

- Is this sustainable?YES! By definition this is sustainable and can bring about a truly green future!