Written by: David Delfassy, Sam Hill — TDK Ventures

Enabling Net Zero

The world is at a critical juncture in its fight against climate change. While achieving net zero is an established global imperative, society has yet to commit to the magnitude of action required to avoid the worst effects of climate change. As a result, we are expected to overshoot global warming limits of 1.5 and 2C. Addressing this challenge will require a multi-faceted approach, combining sweeping emissions reductions with negative emissions activities [1].

Carbon Dioxide Removal (CDR), processes that capture and remove CO2 from the atmosphere, will therefore be one of the most crucial tools for achieving net zero — and instrumental in all net-zero trajectories devised to date [1]. Whilst reducing emissions at the source is vital, many “hard to abate” industries — such as heavy transport like aviation, manufacturing of commodity materials like steel, and agriculture — will continue to generate unavoidable emissions long into the future. This makes achieving net-zero a monumental task, requiring not just reduction but active removal of existing and unavoidable CO2.

Compounding the challenge of meeting net-zero in “hard to abate” industries, is the recent surge in energy demand driven by the rapid expansion of data centers and more pervasive electrification of industries across the board. All of these factors make it increasingly difficult to meet emission reduction targets and risks prolonging greenhouse gas emissions. Indeed, in many cases the near opposite effect is occurring — utilities and grid operators are responding to massive growth by relying even more heavily on natural gas and, in some cases, delaying the retirement of coal plants altogether. In this challenging context, carbon removal technologies are emerging as a crucial complementary solution for companies seeking to quickly power new loads like AI data centers while still pursuing climate goals. As the demand for clean, reliable power outpaces the deployment of renewables, integrating carbon removal into energy-intensive operations provides a pragmatic pathway for companies to mitigate the climate impact of their rapid growth. Spiritus offers a pathway to reconcile this ‘Energy-AI Paradox’, allowing for the expansion of vital infrastructure without compromising climate commitments.

In recognition of these challenges, the U.S. Department of Energy (DoE) and Boston Consulting Group have forecast that the removal of between 5–15 billion tons of carbon dioxide will be required annually [2, 3]. That’s easier said than done; the science of carbon removal demand is well understood, but scaling it to meaningful levels requires significant investment, innovation, and supportive policy frameworks. As a result, it will require willing, visionary, voluntary buyers in the near-term.

The Voluntary Carbon Market: an evolving opportunity

The Voluntary Carbon Market (VCM) has been active for >35 years. Early projects focused on nature-based solutions, such as afforestation (tree planting) and forest conservation, before expanding in scope to include smaller volumes of non-nature-based approaches, such as renewable energy credits. The VCM has grown significantly, reaching a peak of >160 mtCO2 of carbon credit retirements in 2023. However, in recent years the VCM has been challenged by several high-profile scandals which have questioned the credentials of older forestry conservation projects. Such projects contribute a significant share of market volumes, therefore undermining confidence in the market as a whole. This scrutiny, however, creates a flight-to-quality, increasing demand for verifiable and durable solutions like those offered by high-quality CDR approaches.

Challenges for the high-volume voluntary carbon market have timed with the emergence of high-quality CDR approaches such as Biochar, Bioenergy with Carbon Capture and Storage (BECCS), Enhanced Rock Weathering (ERW) and Direct Air Capture (DAC). High-quality CDR credits adhere to a stricter set of criteria, guaranteeing their impact. One crucial difference between high and low quality approaches is durability — requiring that captured CO2 is stored permanently for over 1,000 years. Furthermore, there is a strong role for verification, ensuring that claimed removals are real, measurable and quantifiable.

As advancements in CDR technology drive down the cost, we expect demand to escalate exponentially. Some corporations have gone as far as to indicate they would increase their CDR credit purchases by a factor of 10 to 15 if prices were to drop below $400 per ton. More widely, we believe the threshold at which carbon removal will find mass-scale adoption is in the range of $100 and 300 per ton [7]. At these prices, the forecasted demand requirements for CDR will represent a $1 trillion opportunity annually.

King of the Hill Metrics

TDK Ventures has tracked the CDR sector with the goal to identify the most promising solutions capable of delivering high-quality, scalable, and cost-effective carbon removal. To achieve this, we have established a framework to evaluate the ‘King of the Hill’ for the CDR landscape.

We believe the ‘’King of the Hill’ in CDR will:

▪ Meet all CDR quality standards, for example in permanence, scalability and verifiability

▪ Have a credible route to a levelized cost of capture (LCOC) at early scale which meets the price threshold required to unlock mass adoption — underpinned by low capital expenditure, low energy demand, and ready compatibility for easy implementation (the ability to “cost-down” before “scaling-out”)

▪ Have a credible route to a LCOC of <$100/ton in the longer term, enabling pricing power across the high-quality CDR market

▪ Have demonstrated real commercial traction with a credible plan to deliver on contracted volumes — underpinned by an ability to deliver large-scale projects, likely through a “build-own-operate” model in the immediate term and supported by key partnerships to achieve this

Introducing Spiritus, and Why We Invested

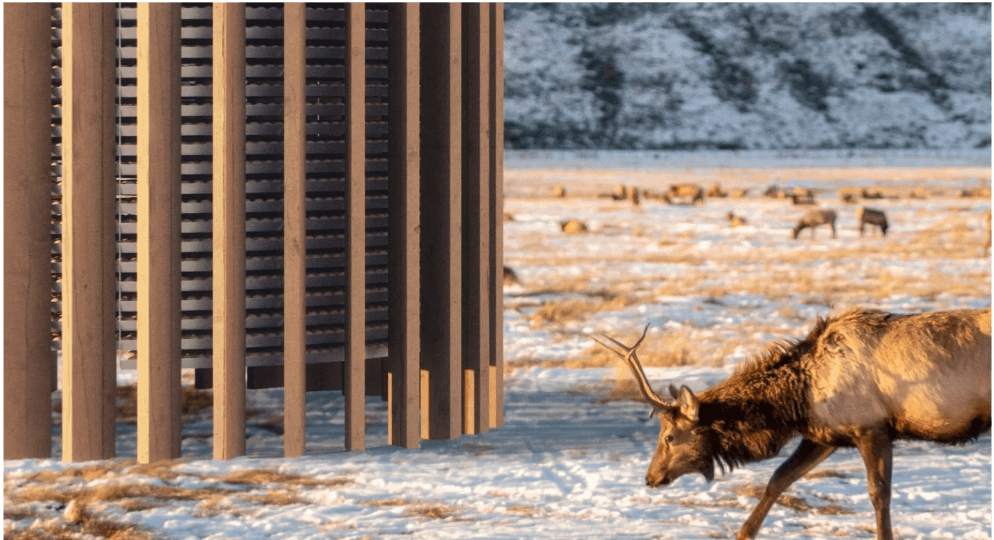

Founded by serial entrepreneur Charles Cadieu, with two successful start-ups under his belt, and seasoned chemical engineer Matt Lee, with a decade of experience at one of the US’s premier national labs, Spiritus is innovating at the forefront of Direct Air Capture (DAC) technology. The company has crafted a unique approach that achieves rapid carbon sorption and desorption rates at a fraction of the cost versus state-of-the-art sorbents. Their DAC approach combines the Spiritus Sorbent and the Spiritus Carbon Orchard, offering a scalable and modular system for low-cost DAC and sequestration (DAC+S). Ultimately, this yields a unique fusion of cutting-edge materials science and scalable process engineering to enable cost-efficient carbon removal.

Supported by our “King of the Hill” criteria, we have identified Spiritus as the King of the Hill in carbon dioxide removal (CDR) for the following reasons:

▪ Spiritus is pursuing a Direct Air Capture (DAC) approach to CDR which meets all of the standards for high-quality CDR. Crucially, we see DAC as the only high-quality CDR approach which can today demonstrate scalability to meet the magnitude of the CDR challenge with the verifiability of removal and capture permanence.

▪ Unlike many DAC approaches that rely on energy-intensive fans or high-temperature kilns, Spiritus leverages passive air contact and requires only low-temperature (~70–100°C) regeneration, dramatically reducing energy consumption and operational costs. Our belief is that, thanks to its unique sorbent technology, Spiritus can reach levelized costs which give carbon removal projects positive rates of return faster than any other approach we have evaluated, and in a way which can scale to billions of tons of carbon removal. Spiritus is targeting a levelized cost of <$100 per ton, a price point widely seen as the threshold for mass adoption and a significant reduction from current DAC costs.

▪ The team has made strong commercial progress which it will serve from its projects currently under development — its New Mexico Pilot Facility and then its first full-scale project, Orchard One, designed for 2 mtCO2 per annum capacity. The company has secured significant advance offtake agreements with Fortune-100 buyers, validating its technology and commercial strategy and the pilot facility is sold out for its first years of operation.

▪ The company has partnered across their supply chain to support delivery of their project pipeline, exemplified by strategic investments by Aramco Ventures and Mitsubishi Heavy Industries.

▪ In addition, Spiritus is led by a dream team of serial entrepreneur Charles Cadieu with technical leadership from CTO Matt Lee. They are assembling a purpose-built team of industry veterans with experience scaling novel clean-tech from lab to full commercial operations, ensuring strong execution capabilities.

Due to this, we believe Spiritus fully aligns with our broader investment thesis, in delivering:

● An attractive and Sustainable Future: we believe CDR will be an essential part of global efforts to combat climate change

● Venture-style Financial Return: we believe that a generational company will be built to address the $1trn CDR opportunity, and that Spiritus is best placed to become that market leader

● Strategic Value with Synergies: in scaling to meet the global challenge, the CDR industry will become a dominant user of energy, constituting an energy transformation megatrend. Specifically, TDK’s expertise in materials science, sensor technologies, and manufacturing at scale presents opportunities for collaboration and mutual growth, reinforcing our belief in Spiritus as a strategic investment.

References:

[1] IPCC AR6 report

[2] BCG

[3] US DOE

[4] Frontier Climate

[5] cdr.fyi

[6] Microsoft

[7] BCG